Smart Budget Planner

That Actually Works

Create budgets that stick with our intelligent budget planner app. Track expenses automatically, set spending limits, and achieve your financial goals with zero manual work.

Why Budget Planning Is Essential for Financial Success

A good budget planner helps you take control of your money, reduce stress, and achieve your financial goals faster.

Clear Financial Goals

Set realistic spending limits and savings targets. Track progress toward your financial goals with visual budget planning.

Emergency Preparedness

Build emergency funds systematically. Budget planners help you prepare for unexpected expenses and financial surprises.

Wealth Building

Maximize savings and investment opportunities. Smart budget planning is the foundation of long-term wealth building.

Peace of Mind

Eliminate financial stress and uncertainty. Know exactly where your money goes and feel confident about your finances.

Complete Budget Planning Solution

Everything you need for successful budget planning in one smart, privacy-first app.

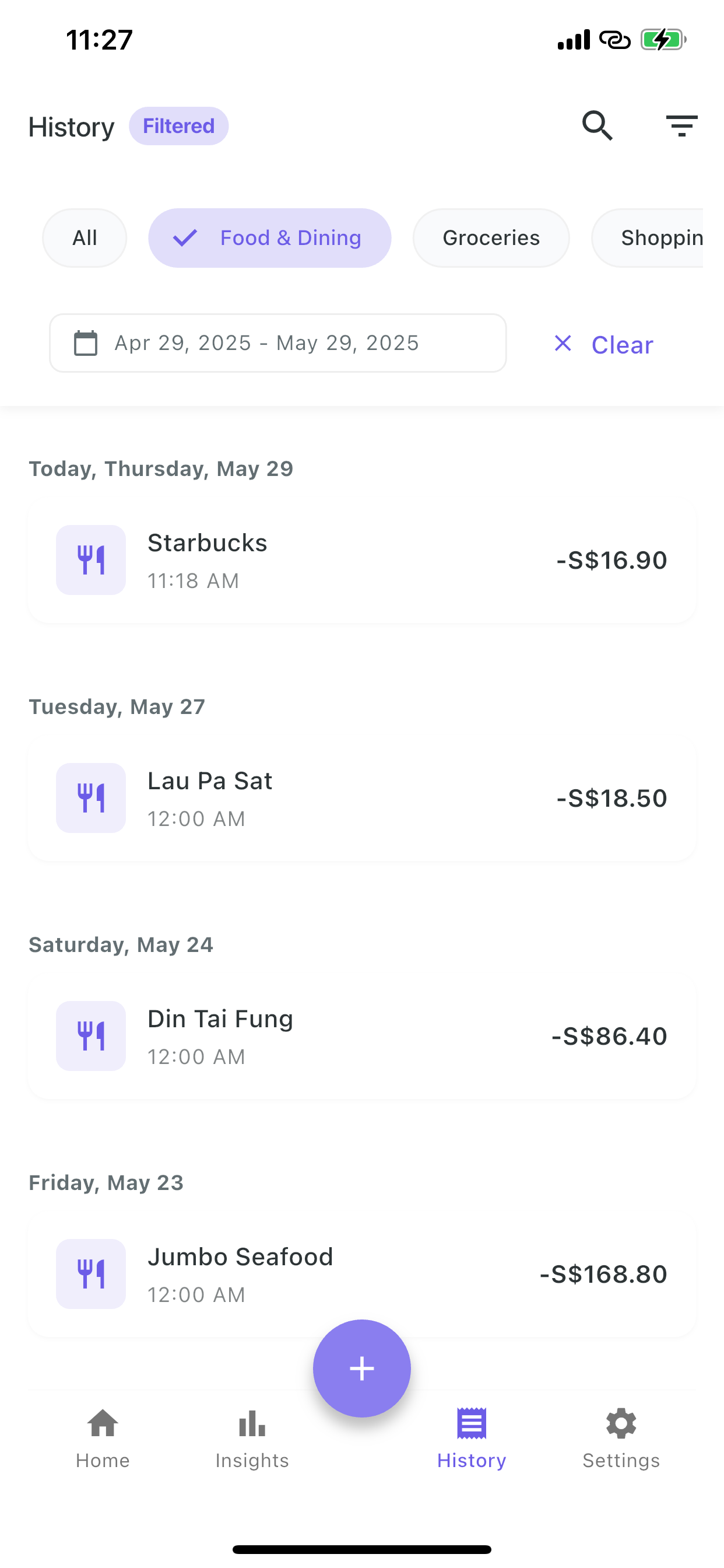

Automatic Expense Tracking for Budget Planning

Never manually enter expenses again. Just snap photos of receipts and watch your budget update automatically. Smart categorization ensures every expense is properly tracked against your budget limits.

- Instant receipt scanning and expense categorization

- Real-time budget tracking and spending alerts

- Smart duplicate detection for accurate budgets

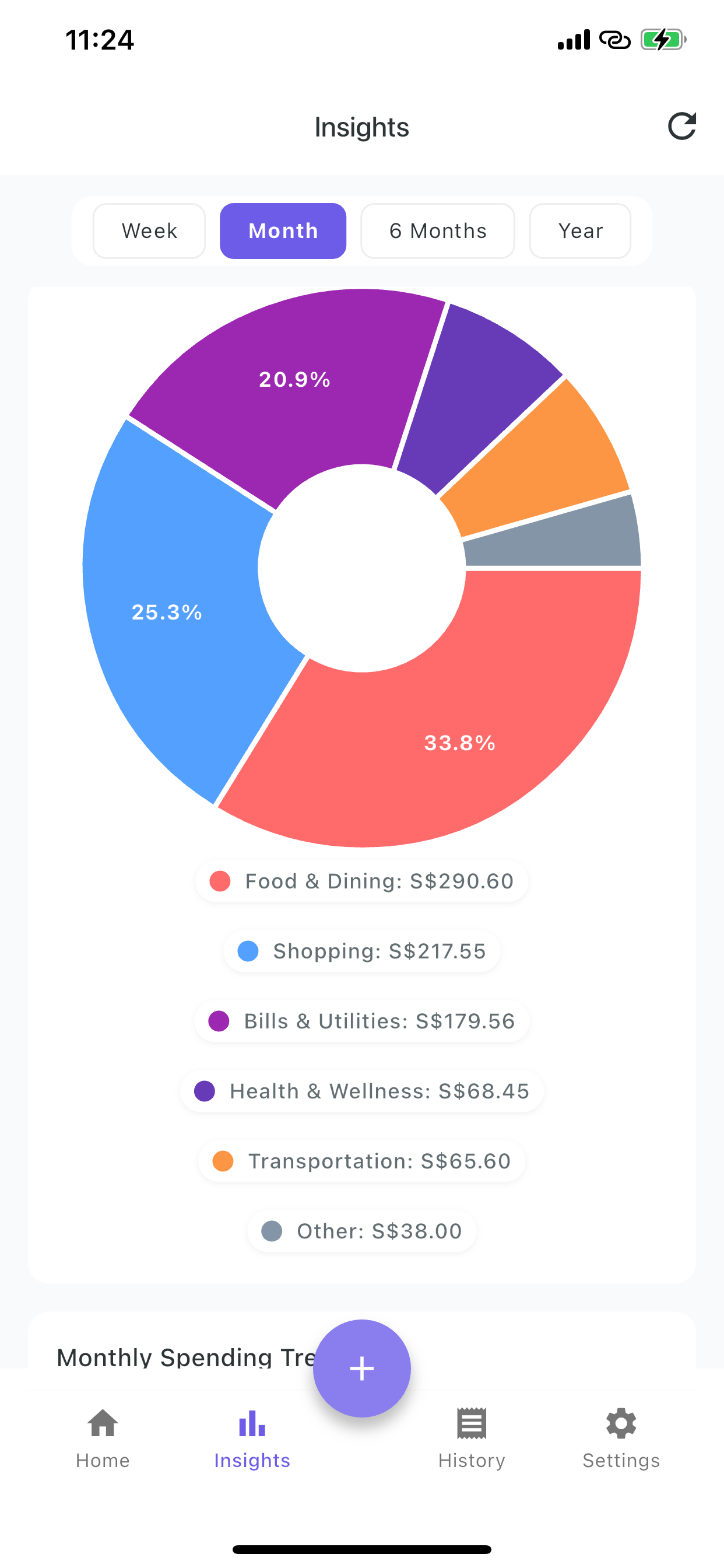

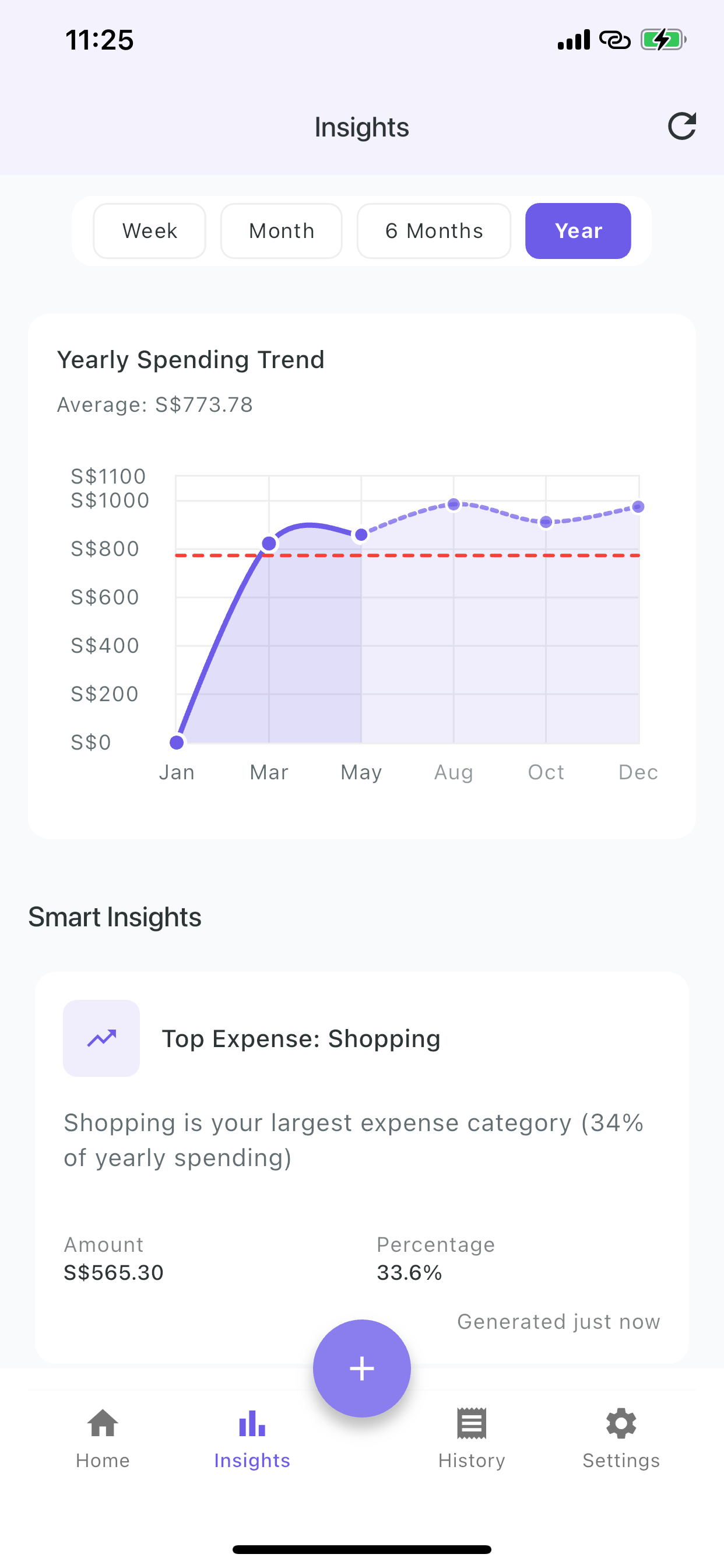

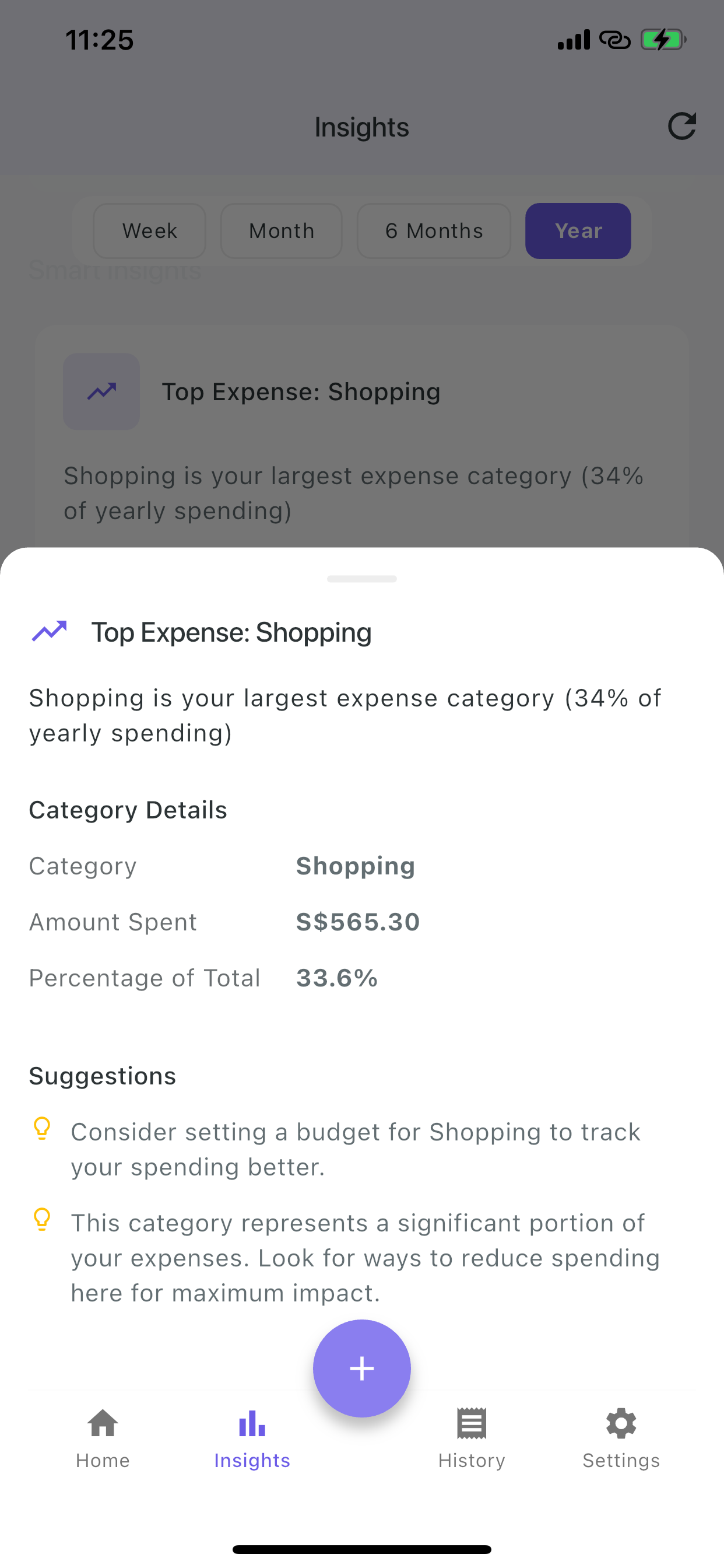

Smart Budget Analytics & Insights

Understand your spending patterns with beautiful budget visualizations. Get personalized insights to optimize your budget and achieve your financial goals faster.

- Interactive budget breakdown and progress tracking

- Monthly and yearly budget trend analysis

- Personalized budget optimization recommendations

Free Budget Planner Template

Start with our proven budget template based on the 50/30/20 rule. Customize categories to fit your lifestyle and financial goals.

Monthly Budget Template

Needs

Housing, utilities, groceries, transportation, minimum debt payments

Wants

Entertainment, dining out, hobbies, subscriptions, shopping

Savings

Emergency fund, retirement, investments, extra debt payments

Sample Budget Categories

Essential Expenses (50%)

- • Rent/Mortgage: 25-30%

- • Utilities: 5-10%

- • Groceries: 10-15%

- • Transportation: 10-15%

- • Insurance: 5-10%

Discretionary Spending (30%)

- • Dining Out: 5-10%

- • Entertainment: 5-10%

- • Shopping: 5-10%

- • Subscriptions: 2-5%

- • Personal Care: 3-5%

Budget Planning Best Practices

Expert tips to make your budget planning successful and sustainable for long-term financial health.

Start with Realistic Goals

Begin with achievable budget targets. It's better to succeed with a modest budget than fail with an overly ambitious one. Gradually adjust as you build good habits.

Review Weekly

Check your budget progress weekly, not just monthly. This helps you catch overspending early and make adjustments before it's too late.

Automate Savings

Set up automatic transfers to savings accounts. When savings happen automatically, you're more likely to stick to your budget and reach your financial goals.

Track Everything

Include small expenses in your budget tracking. Coffee, snacks, and small purchases add up quickly and can derail your budget if not monitored.

Build Emergency Buffer

Include a small buffer in each budget category for unexpected expenses. This prevents budget failures when life doesn't go exactly as planned.

Adjust Regularly

Your budget should evolve with your life. Review and adjust categories quarterly to reflect changes in income, expenses, and financial priorities.

Budget Planning Success Stories

Real users sharing how ExpenseEasy budget planner changed their finances

"ExpenseEasy's budget planner helped me save $3,000 in 6 months. The automatic expense tracking made it so easy to see where my money was going and stick to my budget."

Sarah Chen

Marketing Professional

"Finally, a budget planner that doesn't feel like work! The app tracks my expenses automatically, and I can see my budget progress in real-time. Game changer for my finances."

Mike Rodriguez

Software Engineer

"I've tried many budget apps, but ExpenseEasy is the first one that actually helped me stick to my budget. The privacy-first approach gives me peace of mind too."

Lisa Thompson

Teacher

Budget Planning FAQ

Common questions about budget planning and using ExpenseEasy

How often should you create a budget?

You should create a new budget monthly, but review it weekly. Monthly budgets allow you to account for changing expenses and income, while weekly reviews help you stay on track. ExpenseEasy makes this easy by automatically tracking your expenses and showing budget progress in real-time.

What's the best budget planner method for beginners?

The 50/30/20 rule is perfect for beginners: 50% for needs, 30% for wants, and 20% for savings. ExpenseEasy automatically categorizes your expenses into these buckets, making it easy to follow this proven budget planning method without manual work.

How does ExpenseEasy budget planner protect my privacy?

ExpenseEasy stores all your budget and financial data locally on your device. We don't require bank account access, and your budget information never leaves your phone. Only receipt images are temporarily processed for text extraction, then deleted from our servers.

Can I customize budget categories in the app?

Yes! While ExpenseEasy comes with smart default categories, you can fully customize your budget categories to match your lifestyle and financial goals. The app learns from your adjustments to improve automatic categorization over time.

What makes ExpenseEasy different from other budget planners?

ExpenseEasy combines automatic expense tracking with budget planning. Instead of manually entering every expense, just snap photos of receipts and the app updates your budget automatically. This makes budget planning effortless and sustainable long-term.

Start Your Budget Planning Journey Today

Join thousands who've taken control of their finances with ExpenseEasy's smart budget planner. Download free and start building better money habits today.

Free download • No bank access required • Complete privacy